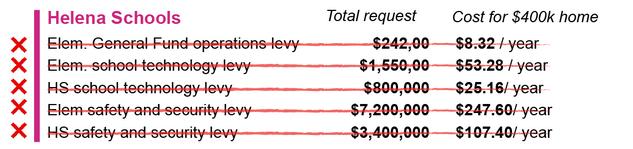

Many school district levies recently proposed across the state have passed and failed. From an article in Montana Free Press, we are able to get a clear view of which levies passed, which didn’t, and costs of the levies. The article reveals a checkerboard of different results.

But that cuts off when we come to see Helena’s levies: All of Helena’s levies failed across the board.

In this Nugget article, it is my aim to find the different reasons as to why these levies failed, and show the opinions of different people involved with the levies. In this article, you will notice many common themes.

It is virtually impossible to talk about the levies without talking about taxes. To add some context to the issue, according to city of Helena finance documents regarding tax price over a 10-year frame (2009-2019) the city wide taxable valuation has risen from $6,371,359 to $8,557,404. Naturally, this comes with an increase in total mill levies, and that was in 2019.

A chart from the Montana Department of Revenue illustrates the average rate of growth in property tax collections from 2013 to 2022. It shows that state property taxes have increased 3.61 percent; Lewis and Clark County taxes have increased 4.6 percent; local schools, 5.42 percent; and Helena city taxes, 3.4 percent. Taxes jumped even higher than that recently.

“The voters are really tapped out,” said Jane Shawn, president of the Helena Education Association in an interview with The Nugget. “The tax was recently shifted from corporations to [the property tax of] homeowners.” So on top of this large increase from 2013-2022, voters were being asked to pay more for local school levies. It turns out that the voters weren’t willing to pay such a high price.

This was a point furthered by Robert Story, executive director of the Montana Taxpayer Association. “[The levies failing] was a result of value increase in houses by around 50%. Taxes went up around 20%. So there was a huge tax increase.”

Taxes are far from the only reason why the levies failed though. According to Ms. Shawn, “We were asking for more money as opposed to other districts.” Furthermore. she said, “The legislature framed the taxes poorly, which sucks because we really needed this. The state funding formula doesn’t pay for all the resources we need.”

This was a sentiment shared by many teachers on the local level as well. “This is the first time that the levies have failed; it’s kinda silly,” said HHS special education teacher Matthieu Oppedahl. “People thought that this money was to put in some more security cameras and update Chromebooks, when really this money was going to go a lot further than that.”

Mr. Oppedahl wrote a letter to the Independent Record supporting his stance in the levies. Below is an attached image of this letter. This letter doesn’t just represent the opinion of Mr. O, but the opinions of many teachers.

Overall, there isn’t just one reason as to why the levies failed. A combination of taxes, poor messaging, big price tags, and the community somehow not seeing the need with the schools all led to a colossal failing of Helena’s levies.